Like all its breakthrough or blockbuster battery technology innovations that CATL has revealed throughout recent months and years, the sodium-ion battery received great fanfare when it was revealed nearly two years ago.

A link to Japanese translation is here.

It’s coming this year, but only in limited quantities.

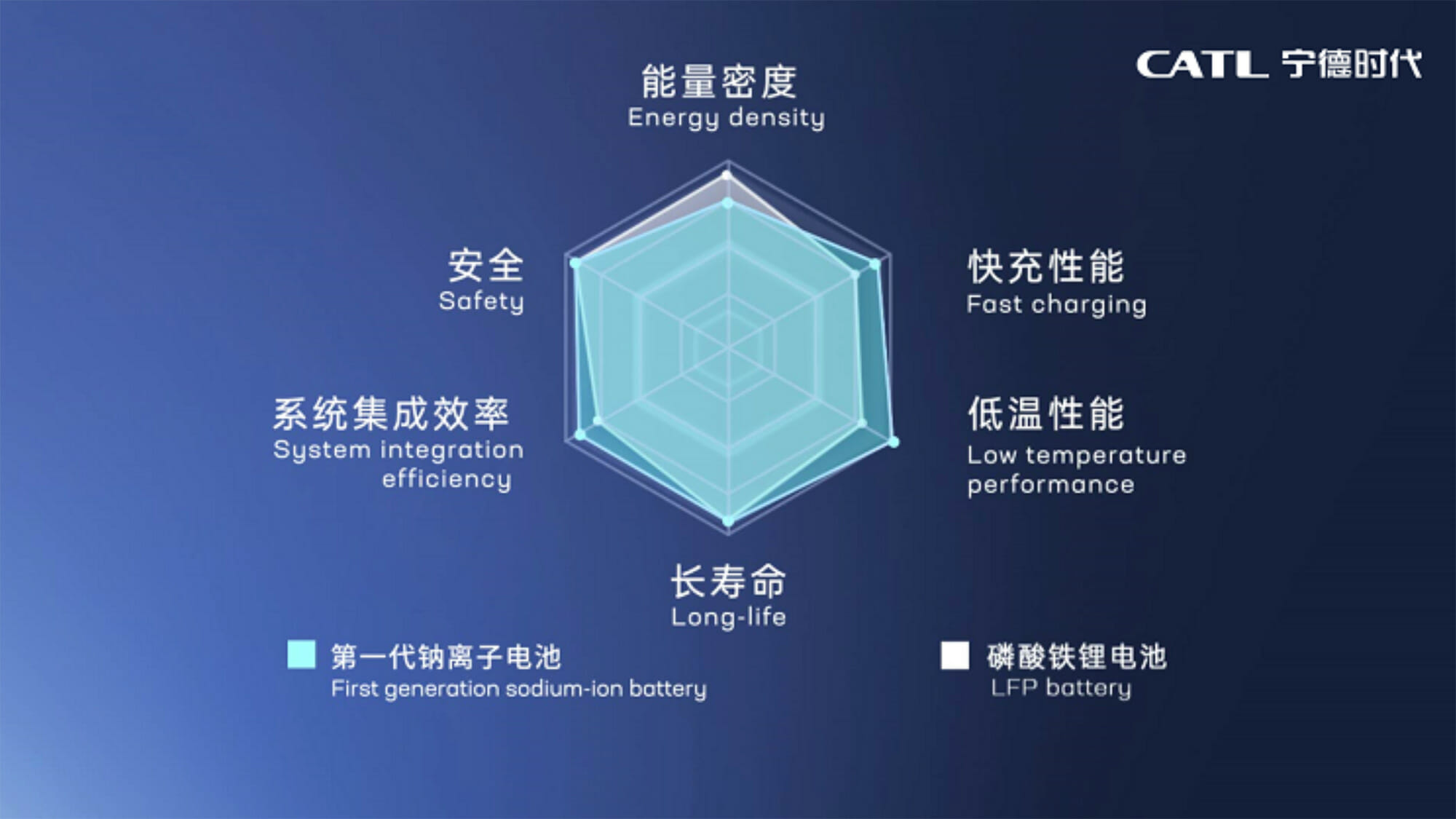

Together with the so-called AB battery pack solution, which integrates sodium-ion cells and lithium-ion cells into one pack, the sodium-ion battery technology unveiled on July 29, 2021 offers these benefits compared with existing mature battery chemistry such as LFP and NCM, at least on paper: higher energy density, faster charging, better thermal stability, greater low-temperature performance and higher integration efficiency.

CATL claimed then that energy density of the sodium-ion cell can reach up to 160Wh/kg, and the battery can charge in 15 minutes to 80% SOC at room temperature. Moreover, in a low-temperature environment of -20°C, the sodium-ion battery has a capacity retention rate of more than 90%, and its system integration efficiency can reach more than 80%. The sodium-ion batteries’ thermal stability exceeds China’s national safety requirements for traction batteries. The first generation of sodium-ion batteries can be used in various transportation electrification scenarios, especially in regions with extremely low temperatures.

Like a lithium-ion battery, sodium ions shuttle between the cathode and anode. But sodium ions have a larger volume and higher requirements regarding structural stability and the kinetic properties of materials. CATL claimed that it has solved this industrialization bottleneck by applying Prussian white material with a higher specific capacity and redesigned the bulk structure of the material by rearranging the electrons, which takes care of rapid capacity fading upon material cycling. On the anode side, CATL has developed a hard carbon material that features a unique porous structure, which enables the abundant storage and fast movement of sodium ions, and improved cycle performance.

By using a high-throughput calculation platform and simulation technology, based on CATL’s deep understanding of principles combined with the application of advanced algorithms and computing capacity, CATL researched and developed a chemistry system that is most suitable for sodium-ion batteries, enable them to enter the fast track to industrialization, and continuously evolve. The next generation of sodium-ion batteries’ energy density development target is to exceed 200Wh/kg.

On the manufacturing side, CATL said that sodium-ion is compatible with the lithium-ion battery production equipment and processes, and the production lines can be rapidly switched to achieve a high-production capacity. At the July 2021 reveal event, it targeted to form a basic industrial chain by 2023.

Well, we are now nearly at the halfway point of 2023, and it wasn’t until recently, right before this year’s Shanghai Auto Show to be exact, that more details of the first customers of the sodium-ion were revealed.

One of them is Chery, which made the official announcement when it unveiled its iCAR brand at an event ahead of the show. The first model from the iCAR brand will be powered by the sodium-ion battery and expected to hit the market in the fourth quarter of this year. Chery and CATL also announced their joint battery brand ENER-Q that will introduce sodium-ion, M3P, LFP and NCM battery systems for BEV, PHEV and EREV applications. The sodium-ion could also find its way into additional Chery models such as the QQ Ice Cream and Ant.

Huang Qisen, deputy director of the CATL Research Institute, had openly indicated at the end of last year that sodium-ion batteries would be suitable for BEVs with 400 km of range or below, and with AB battery pack solution, the sodium-ion battery could also support BEVs with range of 500 km. CATL has also disclosed that it plans to establish 5 GWh of sodium-ion battery production capacity this year to support customers and initial commercialization.

Well, this is the part where we talk about the caveat for the sodium-ion, and that not all is rosy as presented.

The energy density of the first-generation of the sodium-ion is pretty good, but it’s less than that of LFP, which is 180 Wh/kg, and that of NCM, which is 300 Wh/kg, hence the limitation pointed out by Huang that it would be suitable for smaller vehicles with shorter ranges, such as the aforementioned models from Chery as well as the BYD Seagull which is also rumored to be powered by BYD’s own sodium-ion batteries in the future. Though the AB battery pack solution combining different chemistries improve the range somewhat, and we already have examples of this on the market already: NIO’s 75 kWh battery is in fact a hybrid battery using both LFP and NCM chemistry.

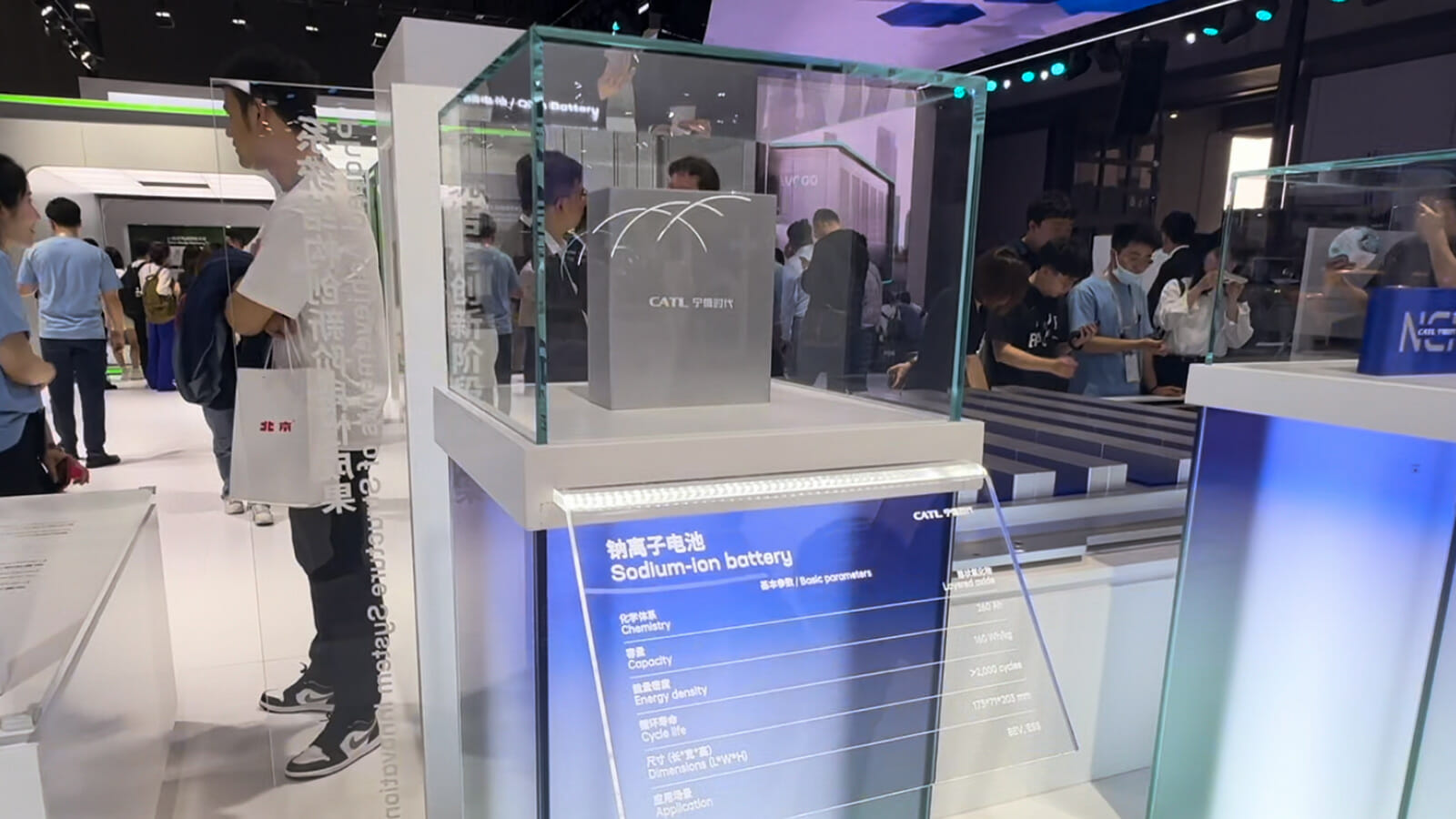

CATL displayed a AB pack as well an sodium-ion cell at the Shanghai Auto Show and I actually spent some time there learning from the engineers trying to get the lowdown on the current status of sodium-ion industrialization. The engineer I talked to did confirm SOP before the end of the year but stressed that it’ll take some time to cultivate the supply chain especially the upstream raw materials.

“The bottleneck remains to be these materials specific for sodium-ion batteries,” the engineer told me. “And that takes time for the supply chain to mature and production to ramp up.”

He also told me that initially production quantity for the iCAR vehicle with sodium-ion will not be that big, which again is affected by the supply chain. The sodium-ion cells will be integrated directly to a pack, utilizing CATL’s cell to pack or CTP technology which is then integrated into the chassis.

There is no question we are definitely seeing sodium-ion going into production vehicles that Chinese consumers will soon be able to buy, but it’s going to take some time to really ramp up significant volumes where we can call it mainstream like LFP and NCM today.

Report by Lei Xing.

コメント