It’s where lithium comes from, not who processes them, for now. Interpretation and fine print matter.

A link to Japanese translation is here.

Tesla Model3 use LFP batteries from CATL

“About three quarters of our lithium come from Australia.”

Tesla CEO Elon Musk inadvertently revealed something at Tesla’s 2023 annual shareholder meeting on May 16 that explains why a couple of its Model 3 variants on sale in the U.S. still gets the $3,750 federal tax credit despite the use of LFP batteries from CATL.

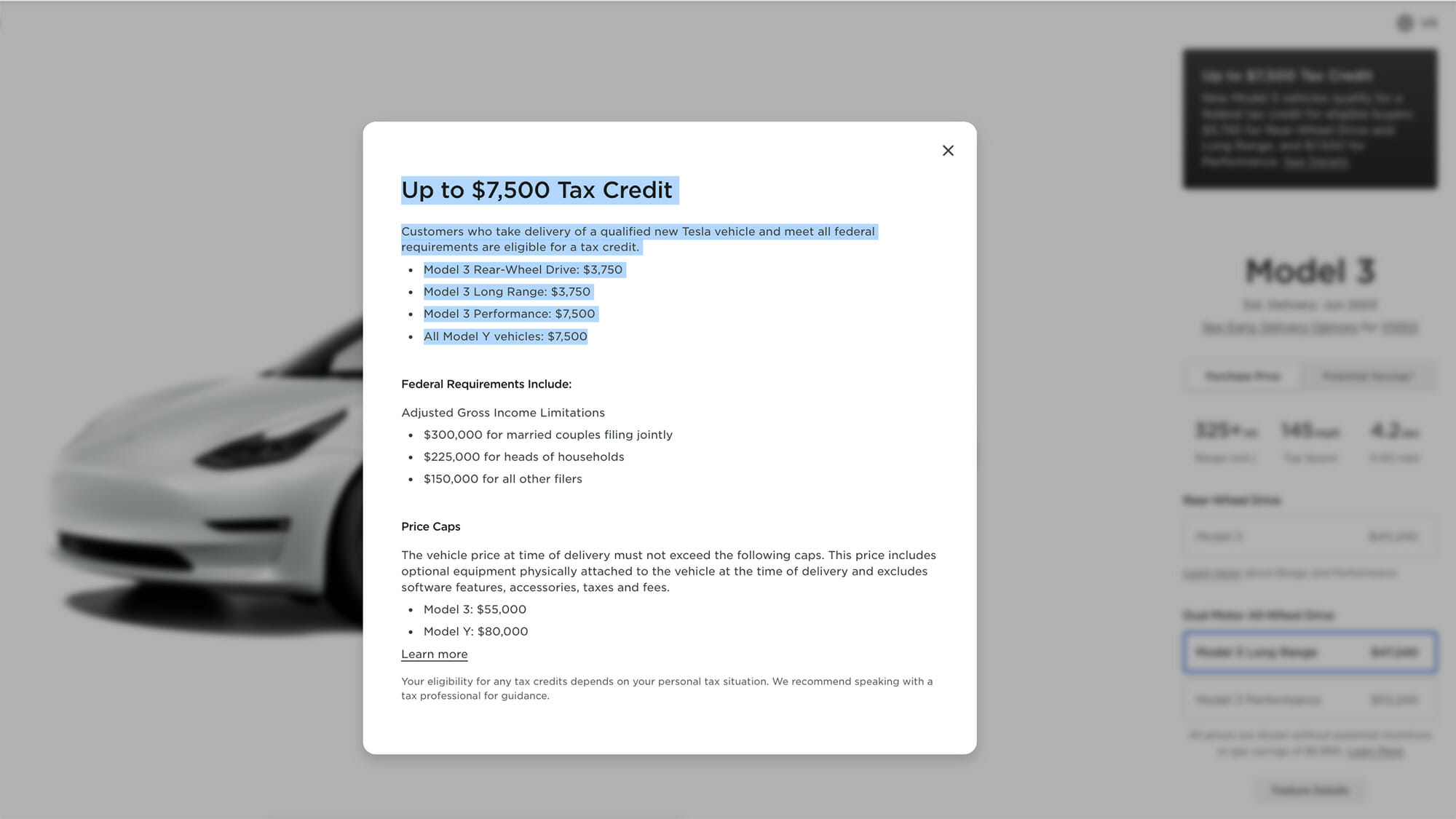

According to Tesla’s website, currently customers who take delivery of a qualified new Tesla vehicle and meet all federal requirements are eligible for a tax credit of $3,750 for either the Model 3 Rear-Wheel Drive or Long Range, and $7,500 for the Model 3 Performance and all Model Y vehicles.

The Model 3 Long Range was relaunched in early May after it was taken off the shelf for U.S. buyers in August 2022 citing long wait times. One of the notable differences was the 325+ mile range rated for the new version compared to the 358-mile range for the older version. The fact that this model variant only gets the $3,750 Inflation Reduction Act (IRA) tax credit would indicate that the batteries are manufactured outside the U.S., and like the Model 3 Rear-Wheel Drive variant, have LFP cells sourced from CATL in China, one of the countries that is a “foreign entity of concern” in the legal text of the IRA.

But here’s the question: the IRA requires that for vehicles placed in service on April 18 and thereafter, they must meet new critical mineral and battery component requirements for a credit up to $3,750 if the vehicle meets the critical minerals requirement only, $3,750 if the vehicle meets the battery components requirement only, $7,500 if the vehicle meets both, and none if neither requirement is met.

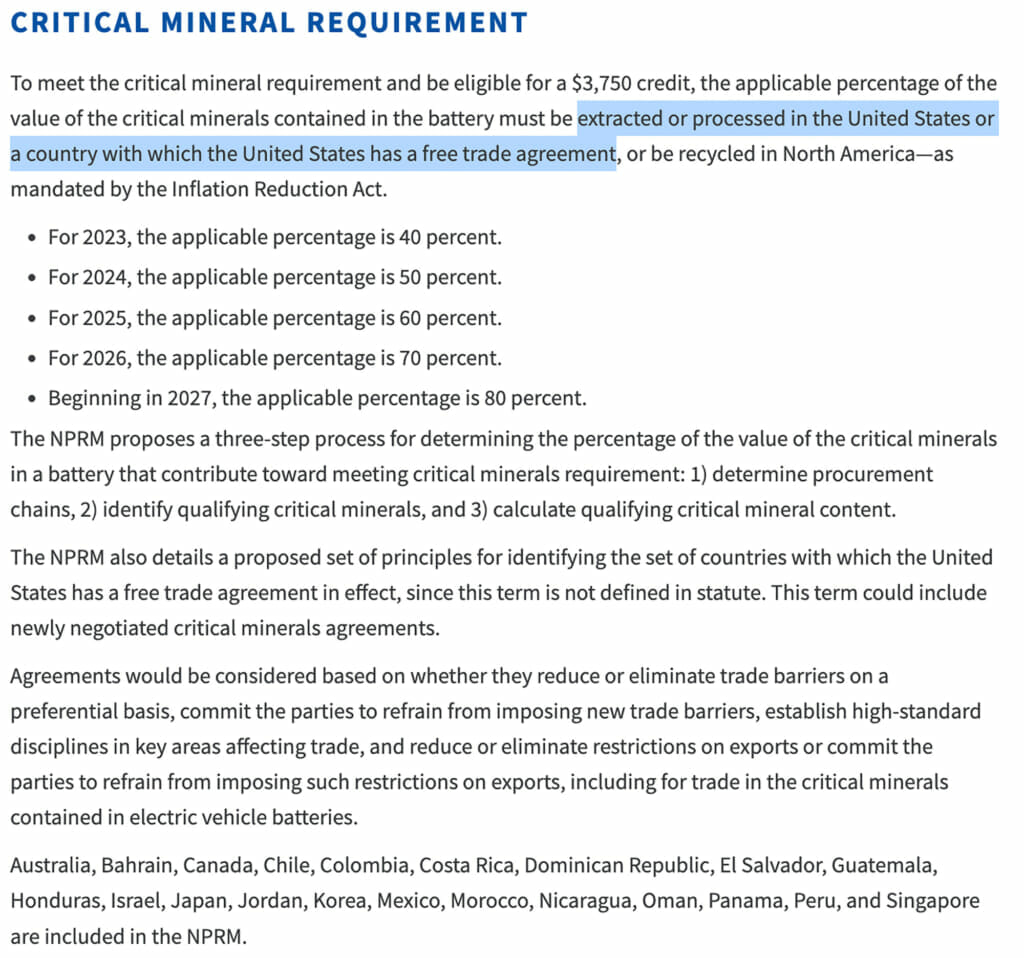

Specifically, in the updated guidance released by the U.S. Treasury on March 31, or what is known as the Notice of Proposed Rulemaking (NPRM), the critical mineral requirement stipulates that the applicable percentage of the value of the critical minerals contained in the battery must be extracted or processed in the U.S. or a country with which the U.S. has a free trade agreement, or be recycled in North America—as mandated by the IRA. For 2023, the applicable percentage is 40%. The battery component requirement, on the other hand, stipulates that the applicable percentage of the value of the battery components must be manufactured or assembled in North America, and for 2023 that percentage is 50%.

So the two Model 3 variants obviously do not meet the battery component requirement since the battery cells are sourced from CATL, but neither should they meet the critical mineral requirement since the materials are processed in China. Why then, do they get the $3,750 credit?

The answer lies in both Musk’s answer on where they get the lithium (Australia) and the wording in the NPRM: “….extracted or processed…” The “or” makes a huge difference. Because in the same NPRM, Australia is listed as one of several countries with which the U.S. has a free trade agreement with.

The two Model 3 variants that do get the $3,750 tax credit, therefore, get them because they meet the critical mineral requirement, not the battery component requirement. The fact that lithium sourced from Australia for CATL’s LFP batteries gets them the tax credit even though the same lithium is processed in China.

This would be the same exact reason why the recently re-launched Ford Mustang Mach-E Standard Range models powered by LFP batteries only get the $3,750 tax credit as well.

But this “loophole” is unlikely to last. In the same NRPM, there is this stipulation on the battery component requirement:

“Beginning in 2024, an eligible clean vehicle may not contain any battery components that are manufactured by a foreign entity of concern and beginning in 2025 an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a foreign entity of concern. The NPRM states that Treasury and IRS will issue subsequent guidance on this provision.”

Going forward, automakers in the U.S. will be moving swiftly to trying to “game the system,” so to say. The Blue Oval City battery plant in Michigan licensing CATL technology and production knowhow announced earlier this year by Ford is just one of those actions trying to address the IRA requirement while reducing EV cost. The plant is 100% owned and operated by Ford and all the workers will be employed by Ford, as CEO Jim Farley stressed on several occasions, and meets the NPRM local production and sourcing requirement post-2025.

Speaking of Farley, he has been quite vocal on China in recent days and at a breakout session at Ford’s 2023 Capital Markets Day on May 22, he said, “for me where the vulnerability is the geopolitics of the processing. That to me is what keeps me up at night,” to which Lisa Drake, vice president, EV Industrialization, Ford Model e, said probably 80% of the processing of lithium and nickel is done in China. The agreements that Ford announced on the same day to source battery-grade lithium from companies such as Albermarle Corp., Compass Materials, Nemaska Lithium, Energysource Materials and Sociedad Quimica Y Minera DE Chile help Ford de-risk the geopolitics of processing, according to Drake, as processing for lithium hydroxide and carbonate will be done in Australia, Canada and Chile.

But all that is going to take time, which is the current constraint rather than the availability of lithium itself, as Musk has stressed often.

There is not enough “non-China” processing to service everybody, which is why the agreements today are so pivotal for us, because we’ve been able to manage our lithium supply chain now without necessarily relying on that processing in China,” said Drake.

For the time being, it’s just impossible and not realistic to erase “China Battery Inc.” off the map for foreign automakers.

Report by Lei Xing.

コメント