A link to Japanese translation is here.

Car production suspended due to Shanghai lockdown

Never underestimate the resiliency of China’s NEV market. Remember, the tipping point has passed.

It has certainly been a roller coaster ride.

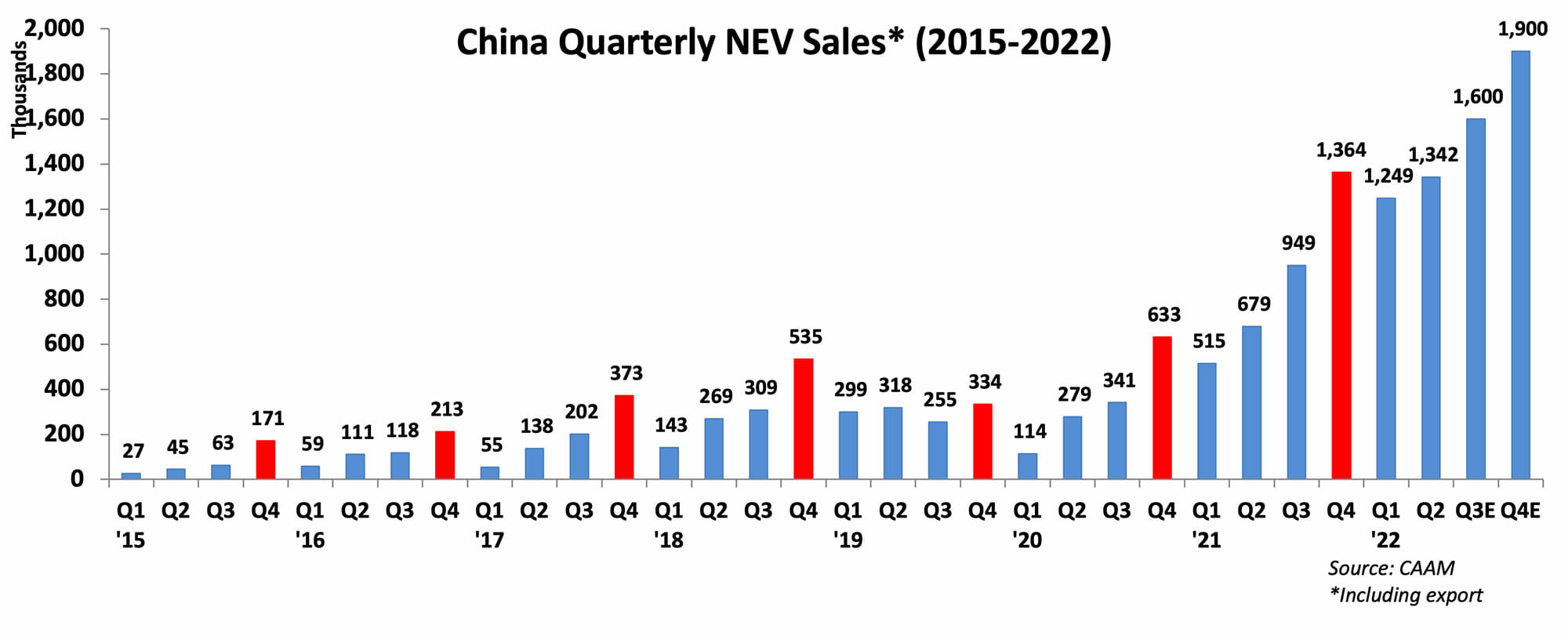

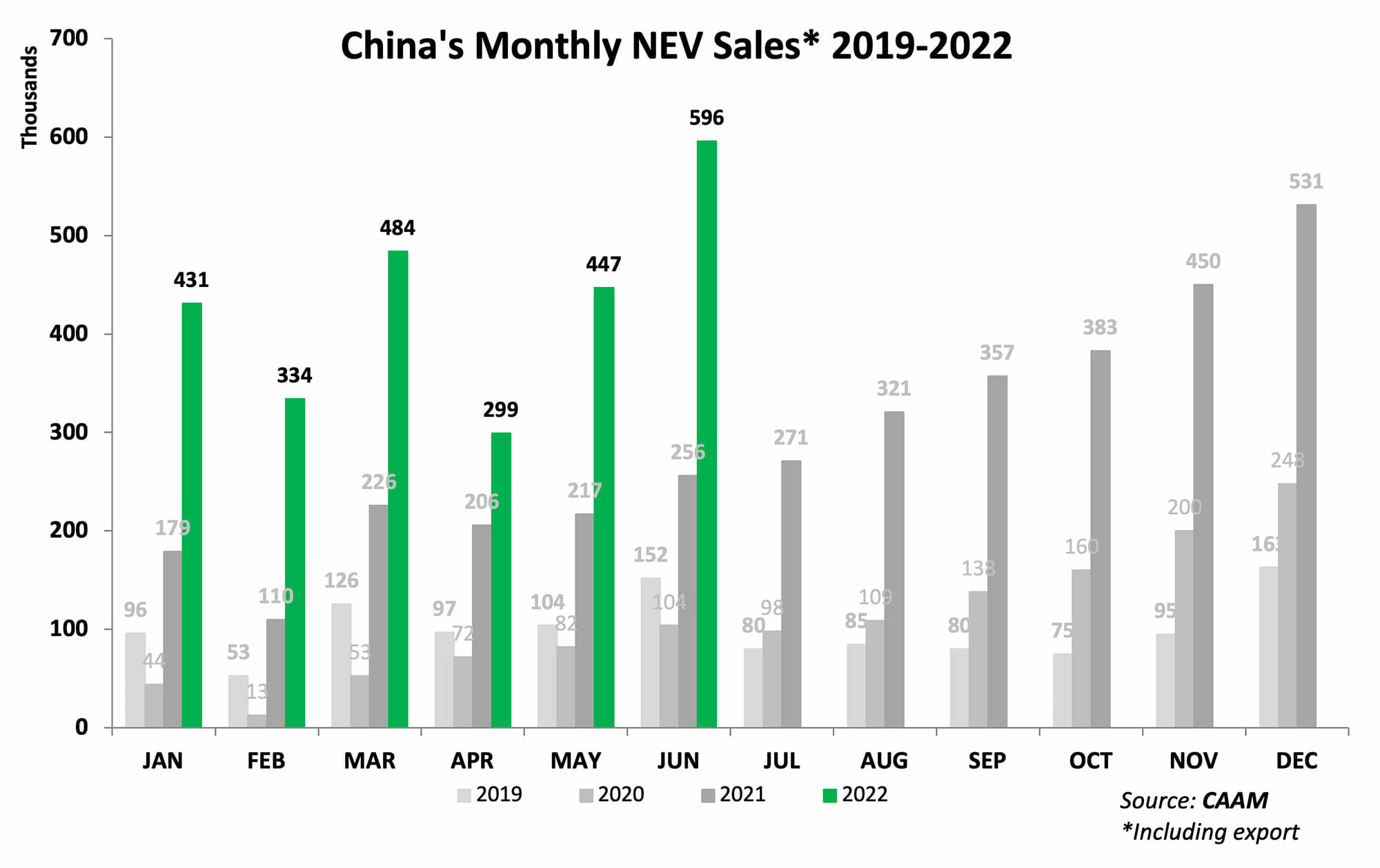

After a scintillating year in 2021 in China’s new energy vehicle (NEVs) market, where sales grew 160 percent to over 3.5 million units based on data from China Association of Automobile Manufacturers (CAAM), I had high hopes at the beginning of this year that sales would surpass 6 million units in 2022.

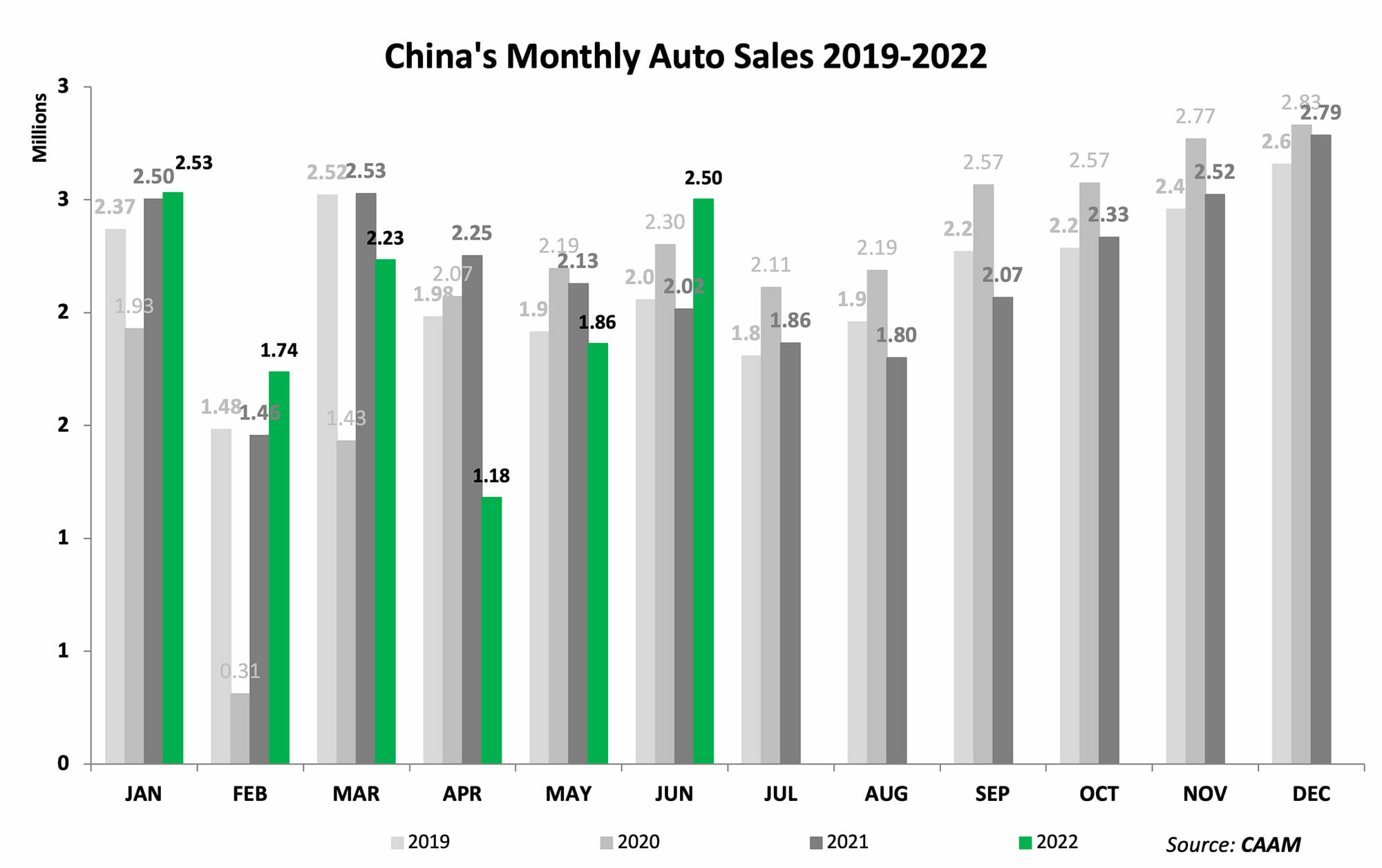

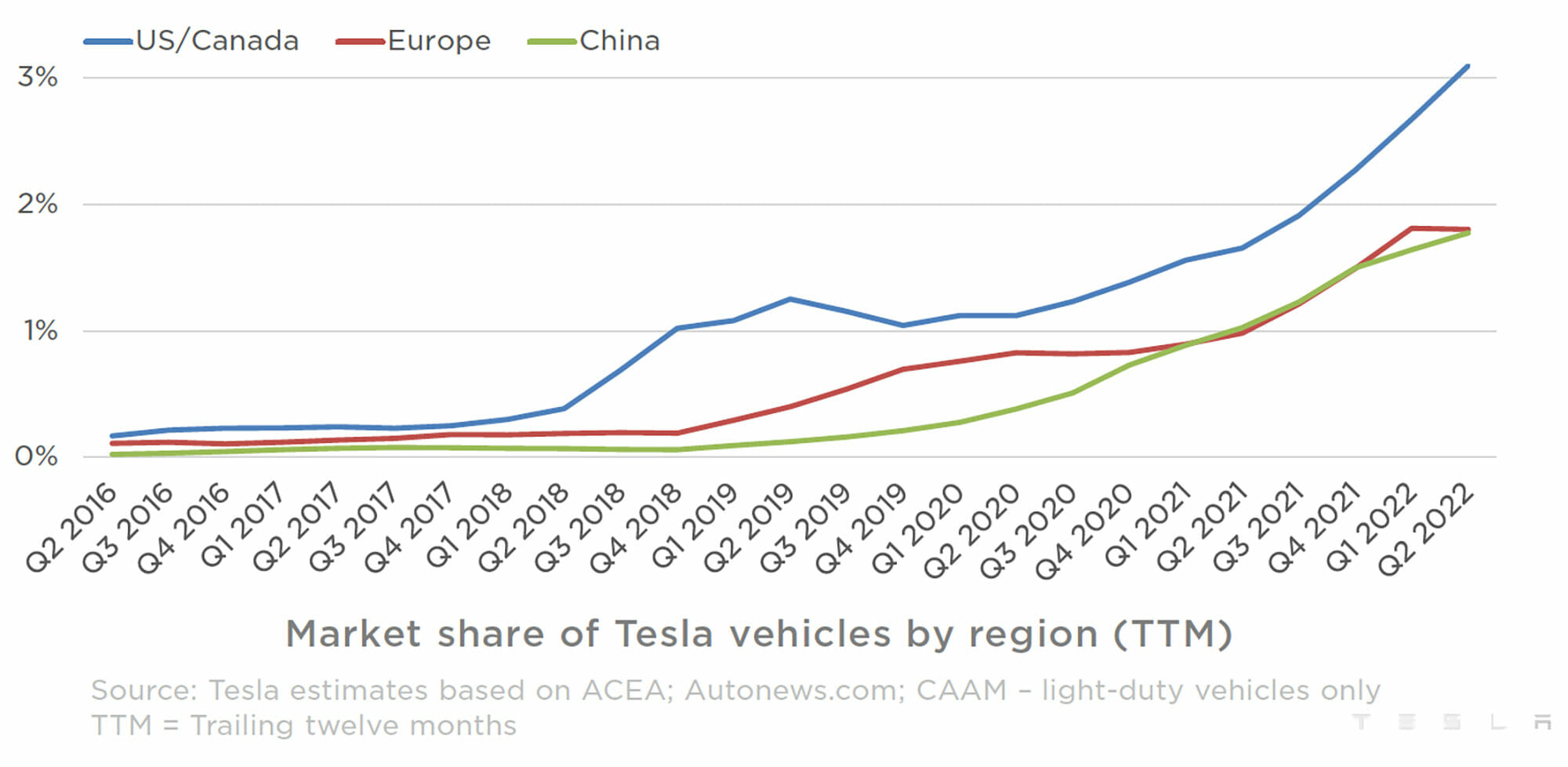

Then Shanghai locked down in April because of a COVID outbreak. The city virtually came to a standstill as surrounding regions and other parts of China fought to contain their own outbreaks. Not a single vehicle of any kind, NEV or ICE, was sold in Shanghai during the month, where automakers including Tesla were forced to shut down manufacturing for better part of the month. Tesla sold only 1,512 vehicles in China in April, according to China Passenger Car Association (CPCA) data, while NEV sales totaled less than 300,000 units, the lowest monthly tally since July 2021, according to CAAM data.

When the April NEV sales data was reported in early May and it wasn’t clear that Shanghai was ready to lift the lockdown anytime soon, I wasn’t sure if China would even be able to sell 5 million NEVs this year. Overall sentiment in the industry was very low.

But somehow, just somehow, be it the persistence of the Shanghai lockdown measures or the perseverance of the Shanghai people, things started to improve as spring turned into summer. Shanghai gradually opened up and manufacturing there and in surrounding regions, a key cluster for OEMs and suppliers, returned to normal. Things always get better, they always do, as the saying goes.

Fast forward to July 1, when leading smart EV startups announced their June deliveries, it was a collective sigh of relief as almost everyone reported all-time highs in monthly deliveries. It was almost like a coming out party, especially for NIO, which had fallen behind others in recent months and was under pressure to deliver a strong month, and it did. A couple of days later, BYD reported an all-time high of more than 130,000 NEVs sold in a month, catapulting it to the No. 1 position in global NEV sales, surpassing Tesla.

596,000 sales in June, the best month ever

On July 6, China’s Ministry of Public Security (MPS) published the latest vehicle registration data as of the end June 2022, which gave an initial glimpse into the first half performance of the NEV market. Nearly 2.21 million NEVs were registered in the first half of 2022, accounting for just under 20 percent of the 11.1 million automobiles registered during the same period. As of the end of June 2022, China had 10.01 million NEVs on the roads, roughly accumulated through the last decade or so. That meant that roughly 22 percent of those were registered in the first six months of 2022 alone, which gives you an indication of the growth. In fact, according to MPS data, China had less than 5 million NEVs on the roads as of the end of 2020, meaning that the stock more than doubled over the past year and a half. The 10.01 million also represents 4X the 2 million or so on the roads as of the end of June 2018, just four years earlier.

The day before CPCA reported new energy passenger vehicle production, wholesale and retail sales numbers on July 8, my own calculation based on all the carmakers that had announced June sales numbers indicated that sales would be well over 500,000 units. Lo and behold, CPCA reported 571,000 units in wholesale and 532,000 units in retail sales, including a record monthly sale of 78,906 units for Tesla, most of those in China. These numbers surprised a lot of people in the industry, myself included.

When CAAM reported overall June NEV sales numbers on July 11 including new energy commercial vehicles, the final tally stood at an all-time monthly high of 596,000 units. That’s nearly twice the number of NEVs sold in in April. The 2.6 million NEVs sold in the first half of 2022 is just 900,000 units from the 3.5 million sold in all of 2021.

So within a span of three months, we have come full circle. What I thought at the beginning of the year, namely China selling 6 million NEVs, now looks certain based on the current momentum barring any major disruptions like the Shanghai lockdown. In retrospective, the NEV market has largely been unscathed from the lockdown, other supply chain issues and global geopolitical environment because of demand that has remained strong as well as carmakers and suppliers were able to work with the relevant stakeholders to keep manufacturing going.

I always say that the tipping point in China’s NEV market has long passed, and demand would never be a problem going forward. Most carmakers including the smart EV startups have a huge order backlog and June sales only reflect orders delivered that might have been placed months in advance. BYD, for example, still has hundreds of thousands of orders on hand (reportedly at 700,000 as of early July). Having sold more than 640,000 NEVs in the first half of 2022, the likelihood that it sells 1.5 million NEVs for the year is now very high, as I pointed out earlier in the year in my article titled “Will BYD sell 1.5 million NEVs in 2022?” That would mean BYD alone would account for roughly a quarter of China’s NEV market this year.

I’m also bullish because of seasonality – second half sales are always higher than first half sales, that’s been a given for years, and Q4 is usually the strongest quarter of the year. This year, in particular, a huge wild card is the purchase tax exemption policy for NEVs will end as of the end of the year. There has obviously been talks about extending that policy to 2023, but depending on when and if that is announced, we could get a significant jump in sales toward the end of the year. In addition, national and local policies in place to spur NEV sales especially encouraging people to trade in their older vehicles for NEVs, such as offering subsidies in excess of RMB10,000, have been unprecedented.

The only thing that will slightly affect NEV sales is the halved purchase tax policy for ICE passenger vehicles below 2.0L and RMB300,000 in place until the end of the year, which will drive up overall passenger vehicle sales and lower NEV penetration. But overall demand and fervor for NEVs will be remain strong regardless of stimulus policies.

All signs are pointing to China selling over 6 million NEVs in 2022. The question is not if, but by how much. Never underestimate the resiliency of China’s NEV market.

*All NEVs mentioned in the article, unless otherwise noted, denote new energy vehicles, and includes both passenger and commercial PHEVs, BEVs and FCEVs. Sales include exports.

Report by Lei Xing.

EVsmart

EVsmart