A link to Japanese translation is here.

Auto Shanghai 2023

After spending six days in Beijing and Shanghai, including three days and 60,000 steps walking the enormous National Exhibition and Convention Center (Shanghai) during Auto Shanghai 2023, or the 20th Shanghai International Automobile Industry Exhibition, I’m at a loss for words on how China, and especially Shanghai, has turned more electric in just a short three years.

The world’s largest auto show in the world’s largest new energy vehicle (NEV) market was an epitome of that transformation: every single vehicle unveiled, launched, or displayed at the biennial show seemed to be an NEV. In fact, many brands exhibited nothing but NEVs.

Let me put it this way: I came, I saw, I felt, I touched, I conversed, I experienced, and I’ve been properly shocked.

Having been a long-time observer of China’s auto market through my previous work at China Auto Review and having lived in the country for two decades witnessing the transformation of the country and the industry, I’m not a stranger to all the changes that have taken place and the speed with which they have taken place over that period. But after being away for three years and three months due to the pandemic and observing the China EV, AV and mobility space from the other side of the world in my new capacity as a co-host of the China EVs & More podcast and freelancing for this platform, even I could not believe what I saw.

Being shocked is probably an understatement and I believe this also holds true for many of the foreign automotive executives who finally traveled to China but couldn’t the previous three plus years due to the pandemic. Many of them spent considerable time on the ground and saw first-hand how China has turned into a country on electric wheels seemingly in no time. Board members from German automakers the likes of Volkswagen Group and Mercedes spent days, if not weeks, in China learning about local market dynamics by meeting extensively with partners, smart EV startups and showrooms, which have taken over malls and shopping centers across China. Mercedes CEO Ola Källenius and Volkswagen Group CEO Oliver Blume both reportedly spent weeks in China and have visited China multiple times since the beginning of this year.

Like many of these executives, it was important for me to go back to understand and have a perspective on what a 25% NEV penetration really means, a percentage that quintupled in three years from less than 5% in 2019 and a target that was reached three years ahead schedule. It’s easy to say these numbers are phenomenal but seeing the sheer number of NEVs running in Beijing and even more in Shanghai – where it felt like every three out of four cars were NEVs – provided a real perspective.

Auto Shanghai 2023 itself served as a great reminder to the world that the tipping point has long passed in the country’s transformation toward electric mobility. The sheer number of brands, vehicles and models on display reflected that as well as the “involuted” nature of competition.

After the show concluded its 10-day run on April 27, the organizers released these final numbers:

• Total exhibition area: 360,000+ square meters

• Number of vehicles on display: 1,413 (1,200 models)

• Number of global debuts: 93 (including 28 from international brands)

• Number of concepts: 64

• Number of NEVs: 513 (including 186 from Chinese brands)

• Number of NEV models: 271

• Number of journalists: 13,000+

• Number of visitors: 906,000

• Number of press conferences on April 18-19: 151

These don’t include the 80,000 or so tulips that were planted at the Polestar booth or the countless internet “cewebrities” or KOLs that were streaming live from many booths. But I digress.

However you look at it, Auto Shanghai was a watershed moment in many ways as the world puts the pandemic in its rearview mirror and continues to follow China’s footsteps on the path toward electric and autonomous mobility. It is now the largest and the only international auto show that is still relevant and truly international if we are talking about Chinese and foreign OEM, supplier and tech startup participation and engagement.

Here are a few of my observations:

The number of Chinese brand NEV models unveiled or launched at the show? Countless. The number of foreign brand NEV models unveiled or launched at the show? Only a handful.

Chinese brands have leapt ahead of foreign brands in design, quality, innovation, and technology in the NEV race, and have stolen the thunder the foreign brands had for years in the ICE era. I wouldn’t have said this four years ago when I previously attended Auto Shanghai, and in my 20+ years of covering the Chinese auto market, I have never seen this much confidence exhibited by Chinese brands and direness exhibited by the foreign brands. This was on full display at Auto Shanghai 2023: just look at the crowds at booths like BYD, NIO, Xpeng, Yang Wang and other smart EV startups or newly emerged brands, and the lack thereof at booths like Buick, Chevrolet, Hyundai, Kia, etc.

It was evident that foreign brands especially the German automakers are trying hard to catch up, whether it’s the entourage of executives and board members visiting China many days ahead of the show or type of slogans put up at events reiterating the in China for China and the world commitment. At its brand night, BMW Group put up slogans such as “what moves Chinese customers today will move the world tomorrow,” what works in China, works all-over the world,” “China is the place to be” and “more impact of our R&D in China, more China in our worldwide R&D organization.” Volkswagen Group announced the formation of the “100%TechCo” akin to GM’s PATAC to speed up local R&D and product launches. Denza, on the other hand, put up this slogan at its press conference: traditional luxury is about logos, new energy luxury is about technology.” It’s a bit crude but that’s kind of what has happened: the Chinese brands have redefined what luxury is all about.

While foreign brands are in catch up mode, Chinese brands are rapidly expanding into various segments such as electric GTs, MPVs and macho off-roaders. The BYD Seagull, Yang Wang U8/U9 and the Denza D9 are perfect examples of this. The Seagull, at a starting price of around $11,000, and the U8, at a starting price of more than $160,000, were two of the mostly watched models not only from the Chinese media but also the global media. Brands like Chery’s iCAR, NETA and GAC AION unveiled or launched their GT models at the most competitive NEV price range of RMB200,000-RMB300,000.

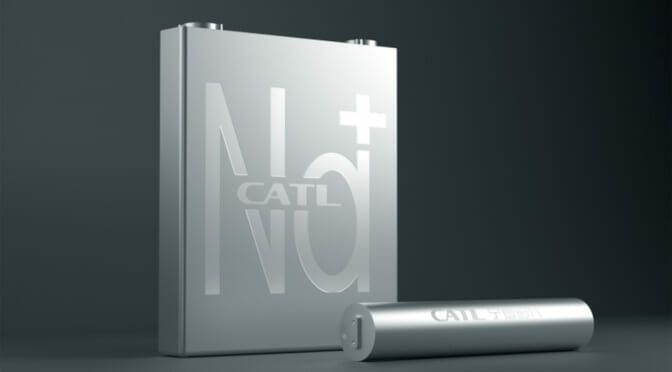

And it wasn’t only the OEMs. Battery king CATL dominated the battery innovation and tech chatter with its Qilin battery finding its way onto Li Auto’s upcoming BEV product, sodium-ion batteries to be rolled out in limited quantities on an upcoming Chery model and the out of this world 500 Wh/kg condensed battery that could see automotive-grade production by the end of this year.

Chip companies like Horizon Robotics, Black Sesame and SemiDrive announced new product offerings and expanded partnerships, while ECARX along with MEIZU showed off its Flyme auto vehicle connectivity innovation as well as its Antora 1000 computing platform and suite of chips that are trying to outcompete with Qualcomm and NVIDIA which dominate the smart cockpit and autonomous driving chip supply in China. LiDAR startup Innovusion showed its latest innovation integrating LiDARs onto windshields, while competitors like RoboSense and Hesai indirectly participated at the show with many of their customers showing off models with their LiDARs.

The competition on city-level point-to-point advanced driver assistance systems (ADAS) feature or the so-called navigate on autopilot (NOA) has been cutthroat and the mic dropped when Li Auto announced its upcoming all-scenario NOA feature will be available to users free for life. Xpeng, on the other hand, in announcing the SEPA2.0 platform prior to the show, aims to reduce powertrain cost by 25% and autonomous driving feature cost by 50% once the platform kicks into full gear.

All of these aforementioned factors mean that the window of opportunity for foreign brands to catch up in the NEV game in China is closing as ICE market continues to shrink and NEV sales grow in a so-called “customer retention” market where the Chinese brands are moving much faster and vertically integrating to address changing customer needs.

Having said that, my initial shock subsided after walking and the show, and I left with a concern: the current brand movement put on by Chinese automakers is unsustainable and not every single one of them will survive. There are a lot of homogeneity when it comes to design and the price competition is cutthroat which is not conducive to the long-time wellbeing and profitability of these brands and companies. It is not clear what the brand or value proposition of many of the Chinese brands that have recently emerged really are, and brands like WM Motor, Hengchi, Enovate, AIWAYS and NIUTRON have either exited the market or are on death watch. In fact, Xpeng CEO He Xiaopeng expects a so-called 32 to 8 evolution in the long-run where eight players will remain each selling 3-4 million vehicles.

Something’s got to give. I believe there will be winners and losers from all three camps: the Chinese smart EV startups, Chinese legacy automakers and foreign legacy automakers.

But make no mistake about it: the Chinese are leading in the NEV race, the foreigners are followers, for now.

EVsmart

EVsmart